JPMorgan Chase shares fell 7% Tuesday after the bank’s president told analysts that expectations for net interest income in 2025 were too optimistic.

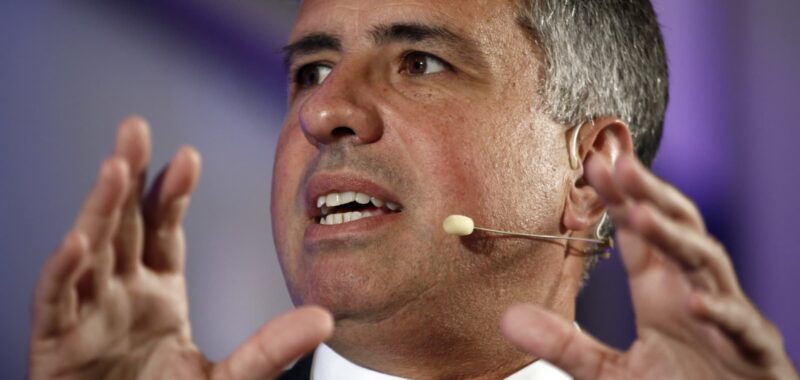

The current estimate for NII — one of the main ways that banks earn money — of about $90 billion is too high given expectations for interest rate cuts, JPMorgan president Daniel Pinto told an audience at a financial conference.

The figure “will be lower,” he said.

The move was the New York-based bank’s worst drop since June 2020, according to FactSet.

This story is developing. Please check back for updates.